Categorize Transactions

Why do you need to categorize Transactions?

Your bank doesn’t know what the transactions it has downloaded are for – only that they have cleared your account. You will need to select the appropriate category and approve the transaction before it is entered in your register.

QuickBooks will make suggestions. Assume that these are wrong 100% of the time. The more you use QuickBooks, the more accurate the guesses will be, but you still want eyes on every transaction before confirming the transaction in accordance with the guidelines in the AYSO Reference Book.

- Transactions should be categorized within 7-10 days from the date of the transaction

- Documentation should be uploaded regularly

- Month end close should occur within 10 days of the prior month end.

If you manually enter transactions when they happen – i.e. you wrote a check and recorded it in QuickBooks before it is cashed – you have the option to match the transaction instead of recording a duplicate. Much like recording your income and expenses on paper, recording your transactions when they happen instead of after they've cleared will give you and your Board better visibility to your financial position.

How do you categorize Transactions

- Log in to QBO

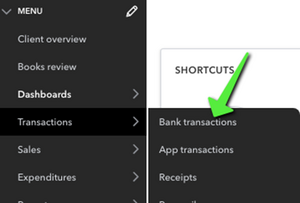

- Select Transaction -> Bank Transactions from the left Navigation Bar

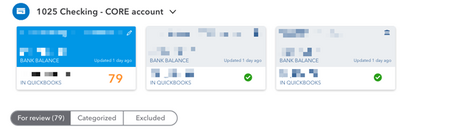

- If you have multiple accounts, you should see them all across the top of the page along with the number of transactions to review.

In the example above, we have 3 Bank Accounts. All are connected to their respective online banking platforms and one of the accounts has 79 transactions to review. You'll see these listed on the lower section of the page

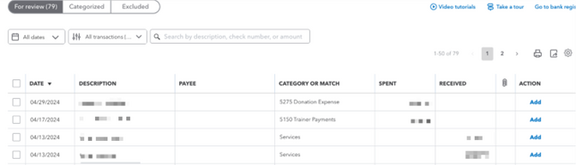

Again, QuickBooks tries to be helpful by suggesting categories for you. Assume that 100% of the time these are incorrect.

- Click on the Category for any transaction you wish to edit and a new screen will expand. Let's look at this a bit deeper:

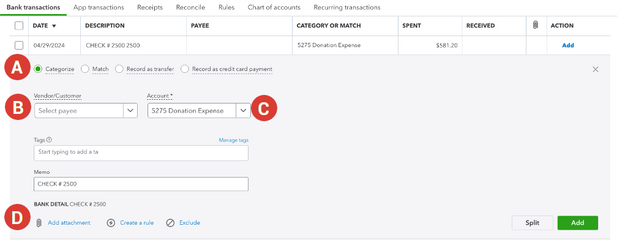

A. How to treat the transaction

- Categorize – This is used to add a new transaction to QuickBooks

- Match – This is used when you have already added the transaction to QuickBooks and it has now cleared the bank

- Record as a Transfer – This is only used if you transferred money between two connected banks in QuickBooks.

B. Vendor/Customer - Enter the vendor name you paid. This is especially important for any of your 1099 vendors to capture payments made. If they aren't in your QuickBooks already, you can Add Customers and Vendors.

C. Account – This is where you will select the correct category for the transaction. You can scroll or type the number or name of the account. As you type, if you elect to do so, the list will begin to show matching options for you to select from.

D. Under the Bank Detail you have the ability to add your documentation, invoice or receipt in accordance with AYSO Reference Book .

- Once you have completed the above section, you are ready to add the transaction to the account register. Some users may see "Confirm" in lieu of the green "Add" button but both work the same.

- Complete these steps until all transactions have been reviewed.

Recording Refunds from Vendors for overpayment

When a vendor refunds an overpayment, this is not Income, but rather a reduction in the expense previously paid. When categorizing, you will categorize this to the same expense account originally paid from.

Example:

- Let's say you overpaid your Storage Expense. The original payment was categorized as "5140 Storage Expenses"

- Then, the Storage company refunded you the overpayment. You would categorize the deposit to the same "5140 Storage Expenses"

- This reduces your total Storage Expenses for the year, so that your report reflects the right amount in the Storage Expenses category

Sometimes, Sections, Areas and Regions will share an expense. As an example, if you share the cost of renting fields with another S/A/R

- When you pay the other S/A/R for your portion of the fields, categorize this expense as Facility/Park Fees.

- When you receive funds from another S/A/R for their portion of the fields, categorize this deposit to offset your expense.

Notes on Categorizing Transactions

- Transactions that are sitting in your "For Review" tab are not yet reflected in your Account Register, QBO Bank Balance, or any Reports you may need to Run for your Board or other Members

- You can not complete a bank reconciliation until all transactions have been reviewed and confirmed

- Rules can make quick work of reviewing repeated transactions; however do NOT utilize the Auto-Add feature of Rules. Please review QBO Rules before using them if you have any doubt

- You can add your documentation after confirming the transaction.

Additional Resources

- QuickBooks Video - Categorize Online Bank Transactions

- What Categories can I use?

- What if I need to add a Category that doesn't exist?

- Why are my Divvy Expenses coming over uncategorized?

- How can I check what Expenses are missing attachments after they've been recorded?