Reconciliation Discrepancies

What are Reconciliation Discrepancies?

When you reconcile an account, you compare transactions in QBO with the same ones on your bank statements. After you review everything, the difference between the ending balance in QBO and your bank statement should be $0.00. When that is not the case, but you force the reconciliation, QBO creates an automatic entry for the difference.

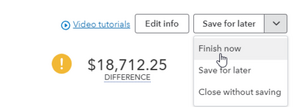

When you are not reconciled, and you have a difference remaining, you will be given the option to Save For Later, Close without saving, or Finish Now.

If you select Finish Now when you still have a yellow error message like above, QuickBooks will automatically create an adjusting entry for the difference.

When should you have Reconciliation Discrepancies?

Short Answer - Never.

In accordance with the AYSO Reference Book, all disbursements should be accounted for, with proper documentation. Therefore, you should take steps to find the error in the reconciliation and resolve it correctly.

How can I avoid Reconciliation Discrepancies?

When your reconciliation is not balanced, before finishing, take a look at the following items:

- Review the Beginning Balance

- Check the Ending Balance and Statement Date you entered (Select the "Edit Info" button above your difference)

- Print out your bank statement and physically check off each transaction marked as cleared in QuickBooks

- Unmark any transactions that are not on your statement

- Enter Transactions that aren't in QuickBooks

If you still can't identify the error, please reach out to Finance@AYSO.Org for additional assistance.

How do I correct Reconciliation Discrepancies I already have?

The only way to correct this is to undo the reconciliation and redo it correctly. Email Finance@AYSO.org and let us know that you need assistance undoing a reconciliation and which bank account(s) you need undone.

Back to QuickBooks User Guide Home | Learn how to Categorize or Match Transactions | Reconciling your Bank and Divvy Account