Difference between revisions of "Collecting Vendor Information - W-9"

From AYSO Wiki

Jeffbailey (talk | contribs) m (Move from noisy template to Category) |

(added vendor validation sentence) |

||

| Line 1: | Line 1: | ||

| − | Before making a payment to a vendor it is important to collect tax information | + | Before making a payment to a vendor it is important to collect tax information. All vendors with payments greater than $600 in the fiscal year might need a 1099. |

| + | |||

| + | It is important to validated the information provided by vendors. See Validating Vendor Tax ID for next steps. | ||

* W-9 is a tax form used by the IRS to confirm a person/company's information. | * W-9 is a tax form used by the IRS to confirm a person/company's information. | ||

Revision as of 01:52, 31 January 2023

Before making a payment to a vendor it is important to collect tax information. All vendors with payments greater than $600 in the fiscal year might need a 1099.

It is important to validated the information provided by vendors. See Validating Vendor Tax ID for next steps.

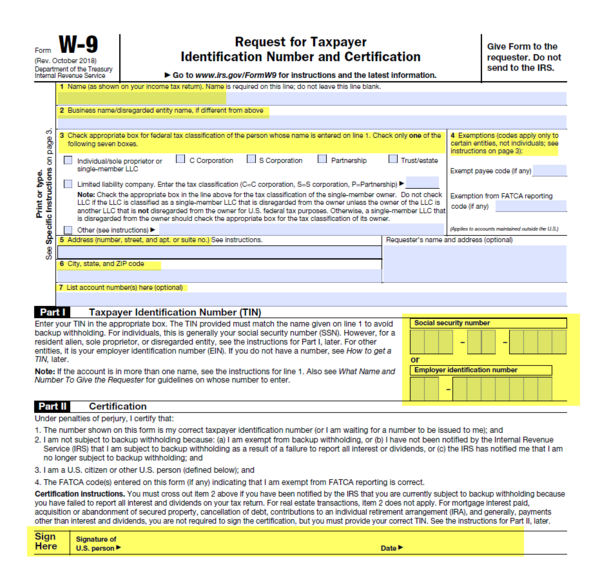

- W-9 is a tax form used by the IRS to confirm a person/company's information.

- Complete form W-9: Request for Taxpayer Identification Number for each vendor submitted. E-mail this form to the AYSO Office Finance Department at finance@ayso.org. The AYSO Office cannot issue a 1099 to a vendor without this W-9.

- Any/all worksheets and W9’s must be received by the AYSO National Finance Department no later than January 10th of each year.

- Region should save all W-9’s in their one-drive folder labeled, W-9